WEALTH HUB JOURNAL

5 Reasons Why Australians Retire Broke— and How You can Avoid it

Wealth Hub Australia

January 24, 2023It’s easy to put off thinking about retirement, especially if you’re young or caught up in the distractions of everyday life. Devising a financial strategy to stay comfortable in your golden years can fall by the wayside when you’re focused on getting to the weekend.

A 2021 survey by Australian National University found that only 38% of Aussies are confident they’ll have the funds to retire. This number has been relatively consistent since 2015.

The key to planning for retirement is creating an effective strategy and implementing it as early as possible. But if you’re already nearing retirement age, it’s not too late!

Here are some of the common mistakes Australians make that prevent them from living the life they want after retirement. With simple planning, you can avoid these pitfalls and have confidence that you will have the resources you need in your golden years.

1. Retiring too soon

At 83 years, Australia has one of the highest life expectancies globally. Meanwhile, the average retirement age for Aussies is 55.4 years old. And if you were born after 1957, you’ll have to wait till you’re 67 to access your pension.

It isn’t difficult to see the challenges here. The average Australian has to wait a decade or more after retirement to start receiving a pension, which isn’t a sufficient source of income anyway. And they have to survive roughly 30 years after retirement on whatever they’ve set up for themselves during their working years.

However, simply waiting to retire still requires you to save now and live frugally in your golden years. Plus, working into your 60s, 70s, or later requires you to postpone the good things that retirement brings — like more time with family and friends, freedom to explore hobbies, relaxation, and travel.

How do you retire comfortably and avoid extending your working years indefinitely? A smart investment strategy can set you up for financial independence. No matter your current age, start investing today to make life easier for yourself when you’re no longer drawing a paycheck.

2. Retiring with debt

Most people know the headache of making payments on their mortgage, vehicles, and other loans. Keeping up with these things can become exponentially more stressful when you’re on a fixed income.

Even if money is tight, now is the best time to reduce your debt. While you’re still making a salary, target your loans with the highest interest rates and attack those first. If you’re buried in mortgage repayments, you may need to re-evaluate your current home. Moving to a smaller dwelling, or a home of the same size but in a less expensive area, can give you an edge in paying off your debt earlier.

3. Underestimating how much money you’ll need

According to the Association of Superannuation Funds of Australia (ASFA), a single person needs $545,000 in super, and a couple needs $640,000, for a comfortable lifestyle after retirement.

Groceries, utilities, and basic necessities add up. And who wants to be on such a tight budget in retirement that you can’t enjoy it?

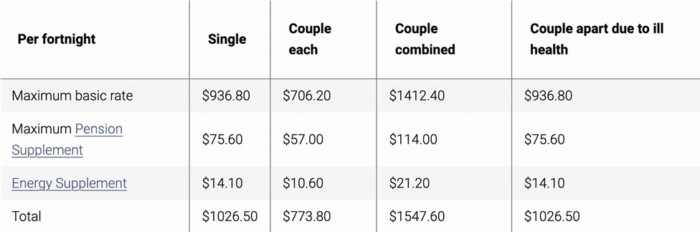

If you don’t have enough money in your super, and you don’t have investments, your pension won’t do much to make up the difference. The maximum basic rate for a single person is $1,026.50 per fortnight or $1,547.60 for a couple combined.

If you want to retire comfortably, you need to focus on building your super and making an investment strategy today.

4. Neglecting your super

To have enough money in your super when you retire, you need to do more than make standard contributions during your working years.

In addition to the required contributions made by your employer, you can take advantage of a “salary sacrifice” strategy. This is where your employer diverts a portion of your salary to make extra contributions before tax. You’re also free to make extra payments on your own after tax.

Even small contributions over time can add up to a significant increase in savings for retirement.

In addition, claiming personal contributions to your super as tax deductions can reduce your taxable income. And if you meet the eligibility requirements, the government can make co-contributions up to a maximum of $500 when you make personal contributions after tax. You can also reduce your tax liability if you’re over age 65 by making a downsizer contribution of up to $300,000 from the sale of your home.

5. Relying on your pension

How much pension you receive from the government depends on multiple factors. The amount you have in your savings, the assets you own, and whether or not you or your partner still work can affect your pension payments.

If you have valuable assets and substantial earnings, your pension can dwindle to a negligible amount.

Even if you receive the maximum amount, your pension won’t be an adequate replacement for the salary you earned during your working years.

Here’s the amount of pension Australians can expect to receive per fortnight at normal rates:

As you can see, relying on your pension will not give you the same level of comfort you enjoyed during your working years. In fact, it’s very difficult to survive on a pension alone. You need other streams of income if you want to retire comfortably.

And don’t forget you won’t be able to receive a pension until you reach a certain age. If you retire in your mid-50s, you may need to survive entirely on your savings and other income for roughly 10 years.

Conclusion

For many Australians, financial stress tarnishes the enjoyment and relaxation they deserve in retirement. If you want to retire comfortably, relying on your pension will leave you disappointed. And there’s a better way than pinching pennies to build your super.

At Wealth Hub Australia, we help everyday Australians develop an investment strategy that allows them to build wealth, achieve financial independence, and retire well. Our referral network of industry professionals will be with you every step of your investment journey.

Contact Wealth Hub Australia today to schedule a free assessment.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*