WEALTH HUB JOURNAL

5 Reasons Why You Should Invest in Property

Wealth Hub Australia

September 26, 2022Today you have no shortage of options when it comes to building an investment portfolio. Shares, stocks, and even cryptocurrencies and NFTs can pay off as investment opportunities. However, market fluctuations or an offhand tweet from the right influencer can send these assets spiraling.

The reality is that nothing beats a tangible asset like real estate when it comes to investing in your future.

Building a solid portfolio of investment properties is a relatively stable and lower-risk investment than the latest intangible coin, non fungible token, or “sure-thing” stock.

Here are 5 reasons why you should invest in property.

1. Plenty of Investment Opportunities

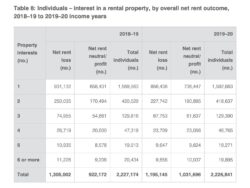

According to recent data from the Australian Taxation Office (ATO), there are 2,226,841 individual property investors in the country. That’s 15.1% of the 14.7 million individual taxpayers in Australia.

However, roughly three-fourths of those investors (1,592,833) own only one investment property. Approximately one-fifth, or 418,637 investors, own two properties, and the number declines sharply from there.

With the right investment strategy andguidance from financial professionals, you can build a strong portfolio of investment properties that will allow you to build wealth, reach your financial objectives, achieve financial independence, retire well, and leave a legacy.

2. Higher ROI

Return on investment (ROI) is how much income you earn on investment versus the amount of money and resources you put into it. With investment properties, rental fees from tenants and appreciation of the property over time can yield a much better ROI than other investment options.

3. More Secure Investment

While the property market does fluctuate over the years, your returns will remain relatively stable compared to the soaring highs and crashing lows of something like crypto or certain stocks.

Thousands of investors can dump a stock or coin on a whim or at the slightest hint of a downturn in the market, but it takes longer to liquidate investment property. So if the markets nationwide have a bad month or there’s negative publicity for a local market, investors can’t cut and run like they can with intangible investments.

That means the real estate market naturally remains more stable, and your property investment is more secure.

4. Tax Benefits

Property investment offers a range of tax benefits if you know how to navigate Australia’s ever-changing tax laws and legislation. Your investment strategy will give you freedom when it comes to your taxable income.

For example, if your investment is “positively geared”,— meaning your intention is to earn passive income — your ROI is greater than your investment. However, some investors aim for “negatively geared” investment assets, where they can claim a loss. This is deducted from their taxable income and can place them in a lower tax bracket, reaping financial benefits that may be better depending on their financial situation.

5. Significant Growth

Property tends to appreciate over time, meaning if you’d purchased property 30 years ago, you’d probably have experienced significant growth since then, especially if you purchased property in a growth area.

In fact, a home bought in 1993 has appreciated by 412% in 2018, according to research by CoreLogic. This means your home would have been worth more than four times as much as you paid for it. For apartments, property value had increased 316% since the same year.

At the same rate of appreciation, if you purchased a home today for $500,000, it would be worth more than $2 million 29 years from now.

Contact Wealth Hub Australia Today

At Wealth Hub Australia, we help everyday Australians purchase the right investment properties based on their current financial situation and long-term goals. With our proven method, we’ll help you navigate the tax landscape, maximise your savings, build wealth, and reach your financial goals.

For a free assessment, contact Wealth Hub Australia today to set up a call.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*