WEALTH HUB JOURNAL

5 Ways Homeowners Can Reach Financial Goals — Without Capital Growth

Web Hub Australia

April 10, 2023Every homeowner should develop a strategy to increase property equity and reduce debt. While home prices in Australia are rising again after tracking downward for 10 months, it’s a good idea to diversify your approach rather than depending on capital growth in a fluctuating market.

Here are 5 strategies to increase equity and reduce debt, regardless of how your home value fluctuates.

1. Refinance to improve the terms of your loan

Refinancing your mortgage can improve the terms of your loan, lower your interest payments, and help you get out of debt sooner. This can be a good strategy if interest rates were higher when you took out your mortgage than they are today.

It can put cash in your pocket, allowing you to make improvements to the property, purchase vehicles or other expensive items, and pay down other loans.

Refinancing also gives you the opportunity to switch to a different type of loan. If an adjustable or fixed-rate mortgage would benefit you more than your current loan, or if a government-insured loan would be better than a conventional loan, this is your chance to improve your situation.

Finding the best path forward would require careful consideration and research. For example, refinancing may expose you to closing costs and other fees. And different lenders may offer different rates. Determine if refinancing is the right strategy for you, and which lender or type of loan will benefit you most.

At Wealth Hub Australia, our referral network of industry professionals can help you determine the best type of loan for your current financial situation and goals for the future.

2. Pay down your principal with extra mortgage payments

Many homeowners make the minimum monthly payment on their mortgage. After all, other expenses like auto payments, holidays, and school tuition are competing for their hard-earned income. However, by paying more than you’re obligated to each month, you can pay less interest in the long run.

Making extra mortgage payments not only allows you to decrease the total interest you must pay over time, but it also helps accelerate equity growth.

Imagine your monthly minimum payment is $1,400. You’ve been paying it faithfully for years, but a significant portion of those payments is going toward interest rather than your principle. Rather than bringing you closer to getting out of debt, this money is going out the window.

To make the most of your money, attack the principal on your loan by paying more or making extra payments. For example, paying an extra $300 each month would increase your total monthly payment to $1,700. Likewise, you could make an extra payment once a year or make half-payments but double your payment frequency.

However, making extra mortgage payments isn’t the best strategy for every homeowner. Some lenders may not accept extra payments or charge penalties or fees. Additionally, you should always keep enough resources on hand for emergencies and to help you achieve other financial objectives. But if your financial situation allows it, paying more than the monthly minimum can reduce the interest you pay and help grow equity.

3. Improve energy efficiency

In addition to the environmental benefits, making improvements to your property that increase energy efficiency can reduce utility costs and increase your property’s value. A future buyer will want an energy-efficient home. Upgrading your home in this capacity can make your property more attractive to potential buyers.

For example, adding solar panels, improving insulation, and installing energy-efficient appliances can be a good investment.

Don’t neglect regular maintenance. Looking after your property helps prevent minor issues today from requiring expensive repairs when it’s time to sell your home. Property that’s been maintained has higher value and assures buyers that the home has been cared for — and there aren’t costly surprises waiting for them after they buy.

4. Rent out extra space on your property

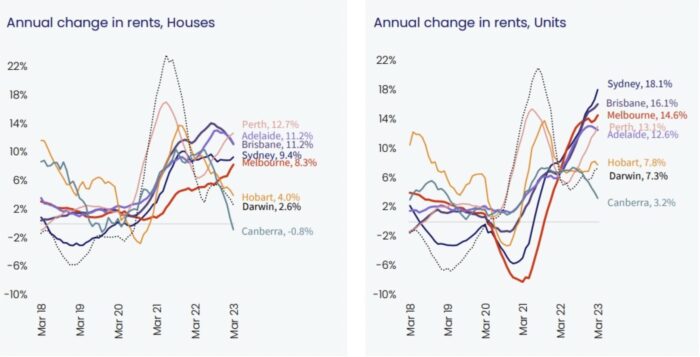

Australia is in a rental shortage, reflected in increased rental prices nationwide.

With rentals in high demand, Australians are looking for quality places to rent that are within their budget. If you have a spare room on your property or a portion of your home that you could rent out, the income you would earn could give you more capital to pay down your mortgage and improve your financial situation overall.

In addition, Australian tax law provides concessions for live-in landlords. You may be able to claim depreciation of assets and related fees, insurance, and mortgage interest at tax time. This can help reduce your tax liability on the income you’ll make as a landlord.

Plus, if the property was your primary residence throughout your ownership, if you rented out a portion of it, you may be eligible for a reduction in your taxes when you sell the home.

5. Open a line of credit

Having a line of credit gives you flexibility to pay more on your mortgage repayments, improve your property, and pay off other loans.

This can make it easier to pay off the principal on your mortgage faster, increase the value of your home, and get out of debt sooner.

Consider whether opening a line of credit is the right strategy for your financial situation. Specialists in our extensive referral network can help you choose the right path for you.

Final Thoughts

These strategies can help you increase property equity and reduce debt without depending on capital growth in today’s market. However, keep in mind these are long-term strategies that require patience. None of these solutions will achieve the results you want overnight. And not all of them may be right for you.

Before making financial decisions that will impact your future, it’s important to use careful consideration and speak with a qualified financial advisor.

At Wealth Hub Australia, we help everyday Australians achieve their financial goals. Through our proven method, we can help you find the right investments, build wealth, get out of debt, reduce your taxes, retire well, and achieve financial independence.

Our extensive network of industry professionals will be with you every step of your investment journey. They’ll be there to answer questions and help you choose the right path to achieve your financial objectives.

Contact Wealth Hub Australia today to schedule your one-one-one breakthrough session.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*