WEALTH HUB JOURNAL

How Many Properties Do You Need in Order to Retire?

Wealth Hub Australia

June 17, 2022To determine how many properties you need in order to achieve financial independence, you must consider numerous factors. It’s also necessary to face some hard truths that you may not want to hear. But addressing them head-on will help you get on the right path to reach your financial objectives.

If you’re interested in buying investment properties, it’s likely that retiring early, or at least comfortably, is high on your list of long-term objectives.

Leaving the world of work behind — including all the stress, uncertainty, and time spent away from family and other priorities — is something that most of us want.

Simply put, retirement means freedom — and with the right planning and investments you can achieve the retirement you’re imagining.

In this article, we’ll look at how you can begin your property investment journey so you can live free from money uncertainty, enjoy the freedom and security of financial independence, and establish a legacy.

Let’s dive right in.

Are You on Track for Retirement?

Most of us wouldn’t call ourselves “wealthy”, even if we fall within the bracket the Australian government defines as such. Wealth status can be highly subjective.

However, according to the Australian Bureau of Statistics (ABS), if your retirement income is $800 per week or more, you fit the definition.

Unfortunately, more than one in four older Australians live in poverty, and more than 7 per cent of the homeless population is aged 65 and older.

In June of 2021, 2.8 million older Australians (67 per cent of the age 65+ population) received an income support payment. This is an increase of 200,000 people over data collected in 2018.

Here’s the breakdown of the types of government assistance they received:

- Age Pension – 93 per cent

- Disability Support Pension – 3.7 per cent

- Carer Payment – 2 per cent

- JobSeeker Payment – 1.1 per cent

As you can see, much of the retirement-age population isn’t financially independent, but there are alternatives to relying on government help and living below the poverty line.

If you’re in your 30s, 40s, or 50s, now is the time to be proactive with your finances so you can retire comfortably. But how much wealth do you need to build in order to achieve this?

6 Figures Is Not Enough

The reality is the $100k benchmark many of us have been told to strive for won’t cut it. If you reach age 65 with the standard six-figure retirement income, you might be in for a rude awakening.

Today, a monthly income of $8-9k, for example, may sound quite comfortable. But with the inflation rate set to hit 7 per cent by the end of the year and global financial uncertainty in the headlines, your retirement lifestyle at $100k might not be what you expect.

If you’re in your early 40s, due to continued inflation you may need a retirement income of more than double that amount by the time you reach 65 to live the lifestyle you’re imagining.

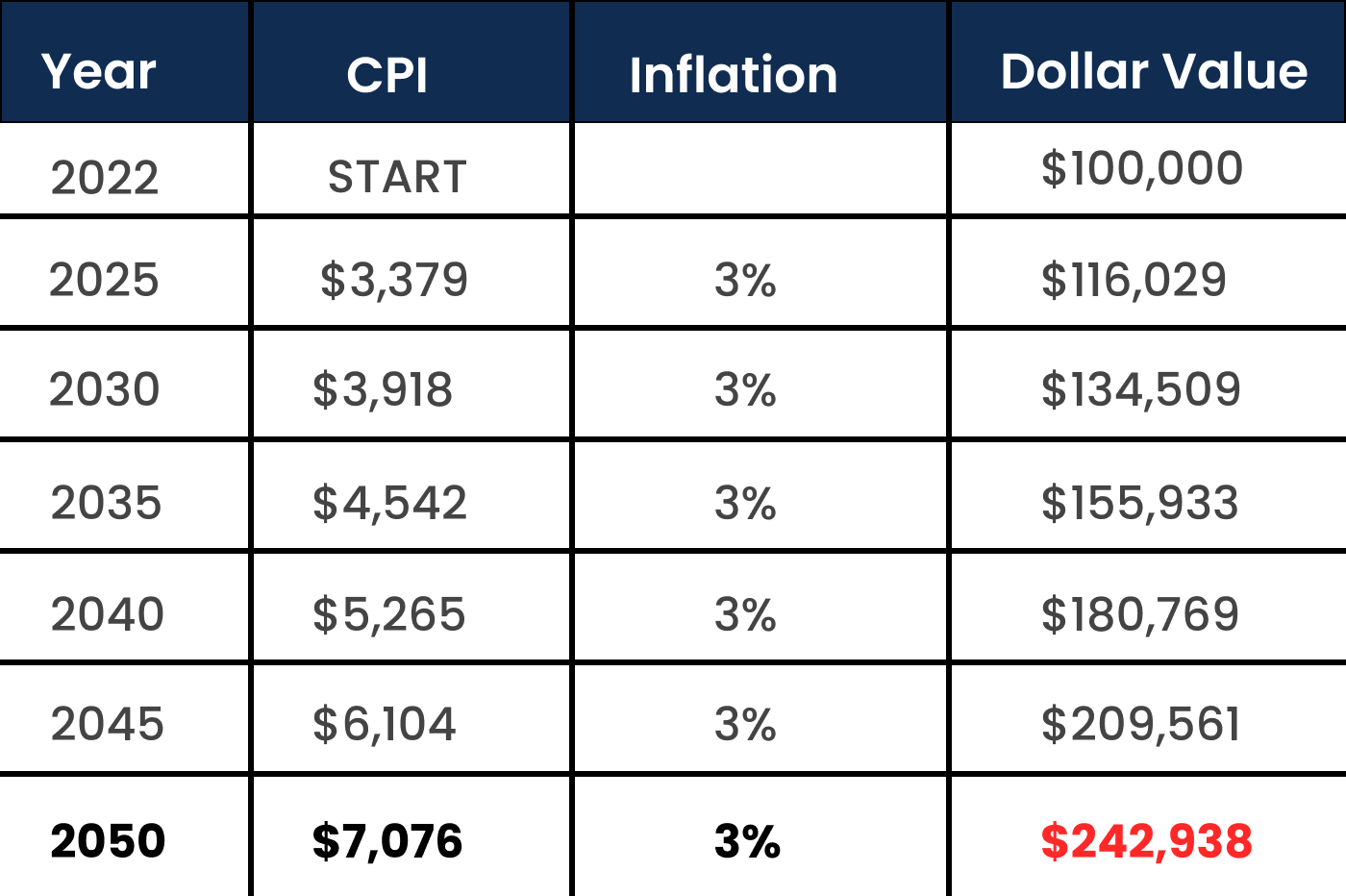

If you have $100k today, here’s what that amount will be worth every five years at 3 per cent annual inflation rate. Keep in mind the current rate is 5.1 and expected to continue rising.

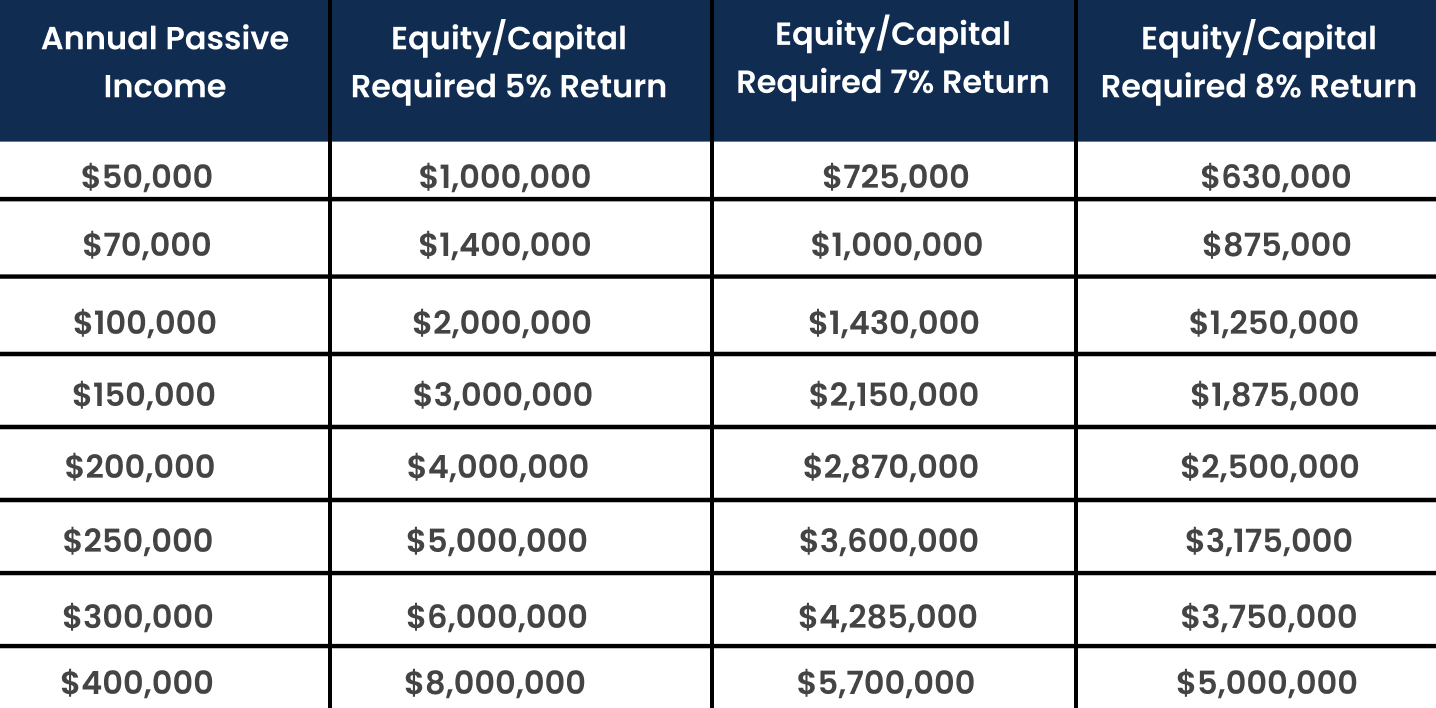

Some quick math for your portfolio: to make $200k in annual passive income when you hit retirement age, you’ll need nearly $3 million in equity.

So, reality check: one or two investment properties might not be enough.

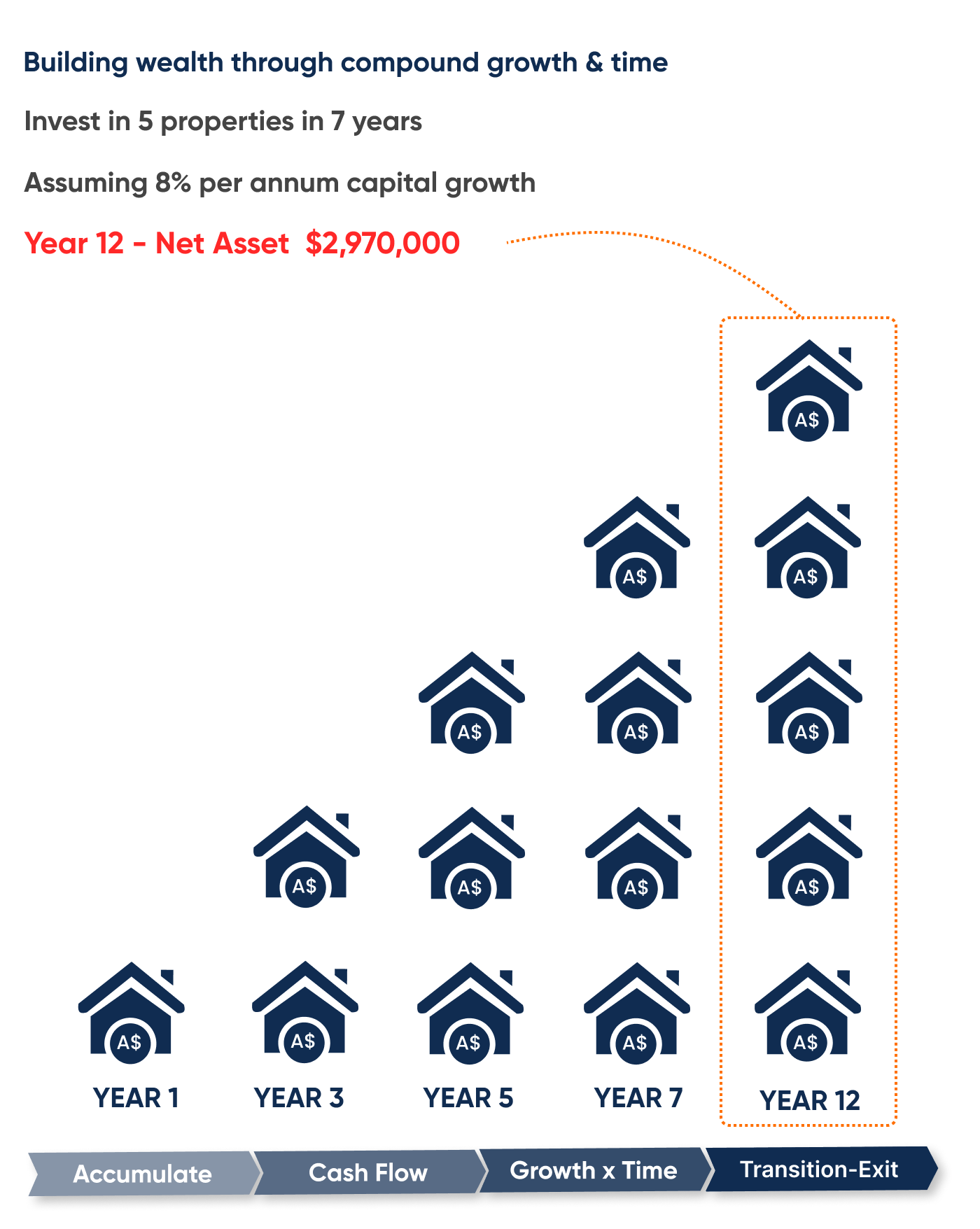

The key to overcoming this shortfall is compound growth, and if you’re still many years away from the age at which you wish to retire, that will work in your favor. Thanks to compound growth, here’s what your portfolio would look like if you acquired five investment properties over the course of seven years.

Even if you’re in your 50s, it’s not too late to build a portfolio that will allow you to live the retirement lifestyle you want.

How to Retire in Style

While having one or two properties in your investment portfolio likely won’t set you up for the retirement lifestyle you want, there are steps you can take today to build your portfolio and achieve the retirement of your dreams.

At Wealth Hub Australia, we help everyday Australians achieve their financial objectives, build wealth, and reach financial independence. Our referral network of professionals will walk you through the process of acquiring properties and growing a healthy portfolio that will help you reach financial freedom.

This includes step-by-step help with navigating Australia’s complicated tax landscape, accelerating equity growth, choosing the right properties, and making government incentives work for you.

Contact Wealth Hub Australia today for a free consultation.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*