WEALTH HUB JOURNAL

How to Find Property Bargains — 7 Tips for 2023

Wealth Hub Australia

February 6, 2023After property prices skyrocketed in 2022, prices are projected to drop this year. Property bargains will open the door for many Australians who were previously unable to purchase property.

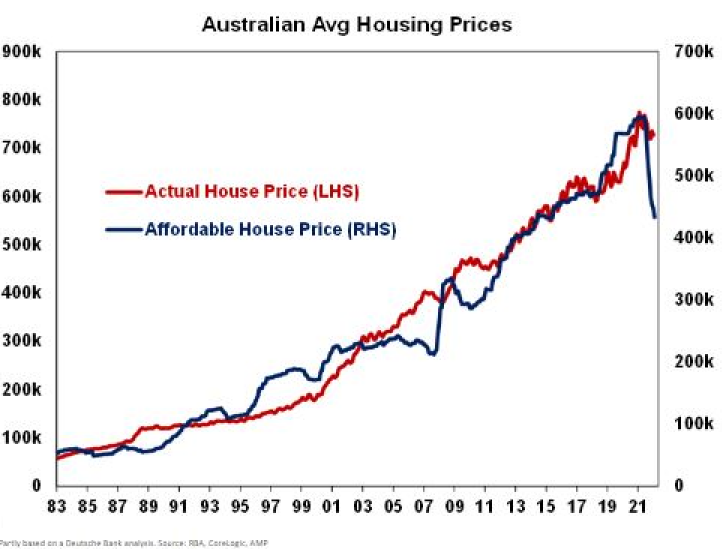

Last year the housing market rose by approximately 30% to its peak in April. In regional Australia, values climbed 40% from late 2020 to early 2022. Among capital cities, the combined increase was about 25%. Homebuyers nationwide felt the pinch.

However, AMP Chief Economist Shane Oliver predicts prices will fall 15-20% from their peak values by September. While the prices of homes near beaches or coveted schools may be slower to come down, opportunity is on the horizon for prospective homebuyers.

The challenge will be navigating sellers who still expect April 2022 prices. It’s important for buyers to be educated and stand firm. However, negotiations can stall out if not handled properly.

Here are 7 ways you can find the best property bargain in 2023.

1. Get pre-approval

Australia is still in a housing shortage, so you need to be prepared to seize an opportunity when you see it. Before finding a property bargain, get pre-approval so you can proceed immediately.

If you’ve already taken care of pre-approval, contact your financial institute to make sure everything is still in order. Cash rate and interest hikes can affect your qualification.

Wealth Hub Australia can connect you with a mortgage broker to fight in your corner.

You don’t want to miss a great bargain on your dream home because you’re tangled up in financial red tape. If you’re contractually obligated to wait for your home to sell first, or if the seller is afraid you won’t be approved and your “subject to finance” clause will cause the sale to fall through, they may avoid selling to you.

The best way to ensure you can jump on a bargain when you see one is to gain pre-approval.

2. Identify the seller’s primary goal

Not every seller’s sole intention is to secure the highest price for their property. Even if your bid isn’t the highest, a generous settlement period or other special arrangement may tip the scales in your favor. Listen to what the seller really wants and do your best to accommodate. It may help you get a great bargain on your dream home.

3. Know how to spot marketing ploys

The old trick of overinflating prices to create leverage in negotiations is alive and well in the housing market. If a seller starts high, they can “negotiate down” to the real price they wanted in the first place. Other sellers may advertise bargain basement prices knowing they’ll attract interested parties — only to capitalise on the bidding war that ensues.

Walk into any negotiations with these tricks in mind. Stand your ground, even if your desire for a specific property starts to weaken your resolve. Keep emotion out of the negotiation process.

A neutral third party can be valuable here. Wealth Hub Australia can introduce you to an experienced buyer’s agent and other advisors who will help you avoid sellers’ tricks, get the most out of your purchase, and maximise your investment.

4. Research, research, research

It’s stressful trying to determine how much a property is worth. The markets are constantly changing, and there are many factors that can contribute to a home’s value. Before you approach a seller, familiarise yourself with property prices in the area as well as surrounding neighborhoods.

Townhouses, apartments, and freestanding properties will have different values. While prices may be high on one street, the price of a similar home on the next street over may differ significantly. Walk in armed with this information and you’ll have a better chance of getting the most for your buck.

5. Consider ‘fixer-uppers’

If someone in your family has handyman skills or if you’re willing to pay a contractor for repairs, it may be worth it to look at properties that need a little care. Other buyers may be scared away from homes that need cosmetic or other repairs, and you can use that to your advantage. Imperfections give you leverage in negotiations. Considering the costs and continuing delays for construction materials, plus the headache of handling the remodeling after purchase, can put you in a good position to argue the price down.

6. Do your due diligence

While a need for minor repairs can lead to a bargain, you don’t want to be stuck with extensive and costly repairs after you purchase your home. Hidden issues like pests, black mould, or a leaky roof can be a nightmare.

Research the home before you agree to buy. A pest and building inspection can save you from surprises you don’t want. Take the opportunity to get a full building report. If the inspectors find troubling things, weigh the costs and headache of repairing them against the gains you may be able to make at the negotiating table. But be shrewd in your decision. You don’t want a property that seemed like a bargain to turn into a money pit.

7. Shop around

A professional third party can help you get the best rate and incentives from your financial institution. An experienced mortgage broker will help you get the best value for your purchase dollars. If you’re buying property as part of your investment strategy, the price needs to be low enough that your mortgage repayments will be lower than your income.

Conclusion

Property is a great investment. With a strong portfolio you can build wealth, become financially independent, retire early, and establish a legacy. At Wealth Hub Australia, we help everyday Australians achieve exactly this through our proven method. Our referral network of industry professionals will be with you through every step of your investment journey.

Contact Wealth Hub Australia today to book your one-on-one breakthrough session.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*