WEALTH HUB JOURNAL

How to Put an Extra $250 in Your Pocket Fortnightly

Wealth Hub Australia

October 10, 2022As a property investor, you’re entitled to thousands of deductions from your rental properties. And there’s an easy way to claim these throughout the year rather than waiting for your tax return.

Simply change the amount of tax that your employer withholds using the pay as you go (PAYG) withholding variation (formerly Section 221YD).

Let’s look at how varying your PAYG withholding can put more cash in your pocket each month.

How to leverage PAYG to increase cash flow

With the PAYG tax withholding variation, depreciation of your investment property and tax-deductible expenses allow you to reduce the amount of tax withheld from your paycheck.

Imagine getting an extra $500 in your pocket each month — rather than waiting till the end of the financial year — simply by using a PAYG downward variation.

On the other hand, if you want to reduce the lump sum you’ll need to pay at the end of the year, you can switch to a PAYG upward variation. This way, you’ll pay more in withholding each pay cycle, reducing your tax bill when it comes time to pay your taxes.

Whether an upward or downward PAYG withholding variation is right for you depends on your investment strategy, but most property investors opt for a downward variation. This increases cash flow and frees up money for repairs or other investments.

How a PAYG withholding downward variation works

Imagine you have an annual salary of $70,000, and you receive a paycheck each fortnight. You also own a rental property with an estimated annual loss of $20,000. Annual loss is the rental income you receive from the property minus depreciation and the expenses of maintaining the property.

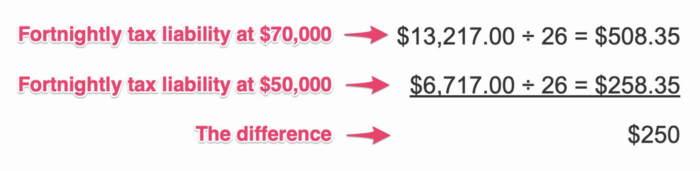

Your estimated taxable income would be $50,000. That’s your $70,000 annual salary minus the $22,000 annual loss. When you apply for a PAYG downward variation, if approved, your tax withholding rate would be based on $50,000 rather than $70,000.

Based on the current tax rate, this would reduce your fortnightly withholding by $250 (or $500 monthly), putting that money in your pocket.

You can use this simple tax calculator to see the difference a PAYG withholding downward variation would make for you.

How depreciation makes a big difference in your PAYG withholding

When it comes to annual loss on an investment property, depreciation is by far the largest piece of the pie. This makes it one of the largest tax deductions you can claim.

In a PAYG withholding context, inevitable wear and tear on your investment property can lead to significant improvements in your cash flow after tax.

Let’s take a closer look at how you can leverage depreciation to keep more cash in your pocket year-round.

Imagine you purchased a home for $800,000 and your depreciation claim for this year comes to $15,000. If you have a PAYG withholding downward variation, here’s how your depreciation deduction would affect your after-tax cash flow, based on a 37% tax rate.

- Annual rental income = $40,000 ($769 x 52)

- Annual expenses = $50,000

- Depreciation deduction = $15,000

- Total taxation loss = $25,000 ($10,000 in expenses + $15,000 in depreciation)

- Tax refund = $9,250 (versus $3,700 without depreciation)

- Fortnightly PAYG cash difference = $355.77 (versus $142.31 without depreciation)

So with the depreciation deduction, your tax refund would be $5,550 higher than without it. And with a PAYG withholding downward variation, you would have an extra $213.46 in your pocket every two weeks.

To start using a PAYG withholding variation to improve your cash flow, you must fill in an application, and it must be approved by the ATO. A professional can help with this process by mapping out the depreciation deductions you’d be able to claim on your property for the next 40 years.

Contact Wealth Hub Australia today

At Wealth Hub Australia, we help everyday Australians establish a roadmap to long-term financial growth. We will help you plan a real estate investment strategy, build wealth, and reach financial independence.

No matter where you are on your investment journey, our trusted referral network of certified professionals will be with you every step of the way. We will help you choose the right investment properties for you and navigate Australia’s complicated tax landscape, leveraging the ever-changing tax laws and legislation to maximise your real estate investments.

We can assist you with investments, debt elimination, finance, property management, tax reduction, and financial planning. Contact Wealth Hub Australia today for a free assessment.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*