WEALTH HUB JOURNAL

Interest Rates Are up, But That Might Be a Good Thing

Wealth Hub Australia

June 5, 2022Interest rates are increasing, but this may be a good time to invest in rental properties due to high demand and rising rental rates.

The Reserve Bank of Australia (RBA) recently raised its official cash rate from 0.1 to 0.35—the first time it’s increased interest rates in over 10 years. This is even higher than the projected 1.5 per cent increase.

The decision has sent shockwaves through the residential property market, fueled by wide reporting in the media. But should Australians be dismayed by this move or do the higher interest rates present an opportunity for home buyers?

Let’s take a look at exactly what the interest increase means for everyday Australians.

Why Prices Are So High Right Now

Much of the world is experiencing the effects of inflation. As goods and services become more expensive across the board, individuals and industries alike feel the burden.

For example, you may have been able to fill your grocery cart while staying under budget a year ago, but today many people in Australia and elsewhere may be cutting nonessentials from the shopping list. The same principle applies when purchasing building materials to construct a new home.

Fingers can be pointed at many culprits for this, including stimulus packages from governments worldwide, to labour and materials shortages resulting from COVID-19, and spiking oil prices and other financial effects following Russia’s invasion of Ukraine.

The cumulative effect of all this is a 5.1% rise in inflation year-on-year, according to the Australian Bureau of Statistics (ABS) in March, when they published their latest report. It’s the highest inflation Australia has seen in a generation.

The RBA’s decision to raise the interest rate is an attempt to stop inflation from rising any higher.

Why Raising the Interest Rate May Help Australians

Most people expected an interest rate increase, but the hike to 0.35 percent surprised the majority of analysts. However, this move to cap inflation is proactive, and the RBA is taking no chances that inflation will break through and continue to rise. They’re taking no half measures, in other words.

And this likely isn’t the last rise we’ll see. The RBA has stated that further interest rate increases will happen until inflation backs down. Even at 5.1 per cent, the interest rate in Australia is lower than in much of the world, with the U.S. at 8.3 per cent and the U.K. at a staggering 9 per cent.

The RBA’s stance has long been that it would wait for wages to increase before raising interest rates, and the bank has stated there are signs this is happening in private-sector firms.

The RBA is banking that their bold action to curb inflation now will be better for Australians in the long run.

Where Are Wages Growth and Unemployment?

The most recent data from the ABS shows a 0.7 percent wages growth by quarter, with a 2.3 per cent increase over the year. This is considerably less than the RBA’s claim that it would wait till wages growth was at least 3 per cent before instituting an interest rate increase.

However, newly elected Prime Minister Anthony Albanese is calling for a 5.1 per cent wage increase for lower-income workers to help them keep up with inflation. This would affect 1.3 million Australians.

In a statement in May, Albanese said, “The government does not want to see Australian workers go backwards; in particular, those workers on low rates of pay who are experiencing the worst impacts of inflation and have the least capacity to draw savings.”

Unemployment is at a historic low in Australia. The RBA forecasts unemployment to fall below 4 per cent this year and remain there next year. With an estimated 200,000 migrant workers arriving in Australia by July, there will likely be a positive impact on inflation as labour shortages ease.

How Immigration Will Affect Vacancy Rates

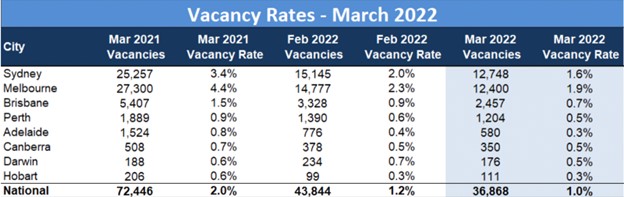

According to SQM Research, the annual rental vacancy rate fell to 1 per cent in March, down from 1.2 from the previous month. Nationwide, the total residential vacancies in March was 36,868, a drop from 72,436 year-on-year. This is the lowest national residential property rental vacancy rate since 2006.

Among capital cities, Melbourne dropped to 1.9 per cent from 2.3 per cent the previous month; Sydney fell to 1.6% per cent from 2 per cent; Brisbane slipped to 0.7 per cent from 0.9 per cent; and Canberra, Perth, Darwin, Hobart, and Adelaide were well below 1 per cent both months.

In Sydney CBD, vacancy rates slipped from 4.3 per cent to 4.1 per cent, and in Melbourne CBD rates dropped from 2.8 per cent to 2.4 per cent.

Image Source

With the borders reopening and immigration and international students returning to Australia, rental properties will be in even shorter supply.

With demand for residential properties higher than ever, the clear immediate fix is to build more residential properties, which household hardware chain Bunnings is helping address by building three new frame and truss plants in Australia.

Also, taking advantage of incentives from the federal government will help first-time home buyers and investors acquire new properties.

How this Affects the Housing Market

The interest rate hike to 0.35 per cent is unlikely to have a significant effect on the market. In Sydney and Melbourne, house prices increased a modest 0.2 per cent and 0.6 per cent. However, Adelaide and Brisbane increased by 2.4 per cent and 1.9 per cent.

So, despite the surprise increase in policy rate, house prices haven’t changed significantly. However, record low prices enjoyed by home buyers last year are unlikely to return anytime soon.

Due to the record low amount of vacancies and border restrictions easing, expect demand for properties in Melbourne and Sydney to climb steeply—and for rental prices to follow suit.

The past year has given us a sample of supply and demand will do to rental prices, with a 22.8 per cent price increase in Sydney, 14.5 per cent in Canberra, and 11.9 per cent in Adelaide. Unit rentals in inner city markets have also increased steeply, with the median weekly rent at $462 nationally. This is an increase of 16.1 per cent year-on-year.

How This Presents an Opportunity

Higher interest rates will make it more difficult for Australians to buy a home. This will affect first-time home buyers, people currently paying mortgages, and property investors.

However, with unemployment at record lows, wages set to increase, and other financial factors, this may be a great time for investors to leverage the current market and capitalise on the increased demand and rates for rental properties.

To learn how you can enter the world of property investing, build wealth, and establish a legacy, schedule a conversation with Wealth Hub Australia today.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*