WEALTH HUB JOURNAL

10 Tips to Help You Eliminate Your Primary Mortgage Faster

Wealth Hub Australia

July 12, 2021Own Your Home and Become Debt-Free!

If you’ve taken a 30-year home loan, you probably dream of paying it off faster. Here are some basic strategies that will help you pay off your home loan in half the time or less.

Most people pay off their home loans little by little, usually based on the schedule dictated by their bank. However, few people think they can pay off their home loans quicker than expected.

Wealth Hub Australia can help you smartly strategise your home loan payment schedule based on your existing budget limitations. Here’s a quick step-by-step guide that will get you started.

STEP 1 : Schedule your home loan payments for whenever you receive your wages.

Most people make their mortgage payments monthly, but you’ll find that switching to twice monthly payments—timed with the days you get paid—will allow you to pay down more of your debt each year. When you make payments every fortnight, you’ll end up making 13 months of mortgage payments in a 12-month period.

STEP 2 : You can use a mortgage as your key financial product.

Mortgage products, also known as 100% offset loans or all-in-one loans, give you the chance to utilise your mortgage as your main financial product. This involves having one account where you redirect all your income. By doing this, you can use most of your income to pay off your loans in large amounts instead of just dedicating a certain percentage of your income to mortgages.

You can still draw your living expenses from this account using a credit card, EFTPOS, or a cheque book, but you need to be mindful of your withdrawals to ensure most of your income is dedicated to paying your mortgage.

Note that this type of loan only works well if you can make additional payments apart from the scheduled payment. If you cannot do so, then you might be better off paying the minimum amount for your repayment loans. This strategy requires dedication, but you’ll end up reducing years or even decades of payments off your scheduled loan.

STEP 3 : Reduce your tax by using a PAYG withholding tax variation.

You can reduce the tax deducted from your scheduled pay cheque using a PAYG withholding tax variation. This will allow you to increase your minimum repayment and proceed with your principal reduction. Nowadays, thousands of Australians are using a PAYG withholding tax variation to reduce their taxes legally and pay off their mortgage faster.

STEP 4 : Consider paying lump sum whenever you can.

When you deposit any lump sum amount into your mortgage, your overall principal and interest will be reduced. For example, if you pay an average of $2,000 for your monthly repayment, this reduces your principal loan by $400due to the interest component in the loan’s early years compared to the last years of the loan. If you pay the additional $400, you’ll save around $1,600 in interest in the long run!

The four steps above illustrate the habits you need to form to reduce the overall lifespan of your mortgage. However, here are some steps you can take to pay off your mortgage even faster:

STEP 5 : Look at available mortgage reviews.

If you cannot use the tips we’ve already mentioned with the loans you currently have, then you should consider looking at loans that offer those benefits. Consult with Wealth Hub Australia to find out what your options are.

STEP 6 : Look at options for early repayment.

There are heaps of options for early mortgage repayment. Look up the terms of your loan to see if you have this repayment option.

STEP 7 : Increase your regular repayments for your home.

This is one of the most common methods of smartly repaying your loans. However, make sure you still have enough money for your daily expenses when you decide to increase your regular repayments.

STEP 8 : Look into starting a reserve fund.

You should check long-term insurance vehicles like super or insurance bonds and start a reserve fund of your own. Although a reserve fund will have a high entry fee and early withdrawal penalties, this method can be tax-effective.

STEP 9 : Find a cheap rate and invest the difference.

As much as possible, shop around for the cheapest loans you can find so you will only have to pay the minimum. Then use the money you save to invest in more profitable endeavors like other types of investment opportunities. Once your investment pays off, you can use that money to pay off a bigger chunk of your initial loan. However, before undertaking any type of investment, it is imperative that you consult with professionals to get sound advice.

STEP 10 : Use your current equity to your advantage.

Once you’ve paid off parts of your loan, you will have equity to use at your discretion. Equity is the difference between your property’s current value and the amount you owe to the lender, and it can be accessed through your existing loan, which you can then use as collateral. Most lenders will let you to borrow using equity as collateral, with up to 80% of the loan-to-value ratio of your equity. You can then use your equity to pay off your loans faster.

The Strategy of an Ordinary Home

OVERVIEW

Banks, credit unions, and building society mortgages are designed so thatonly a small amount of your capital is paid off in the first 15 years of a 30-year mortgage. In this structure, interest is not tax-deductible since your home is your primary place of residence. Because of this, you will always be catching up on your increasing mortgage interest bills with the limited wages you earn after tax.

ANALYSING YOUR MORTGAGE

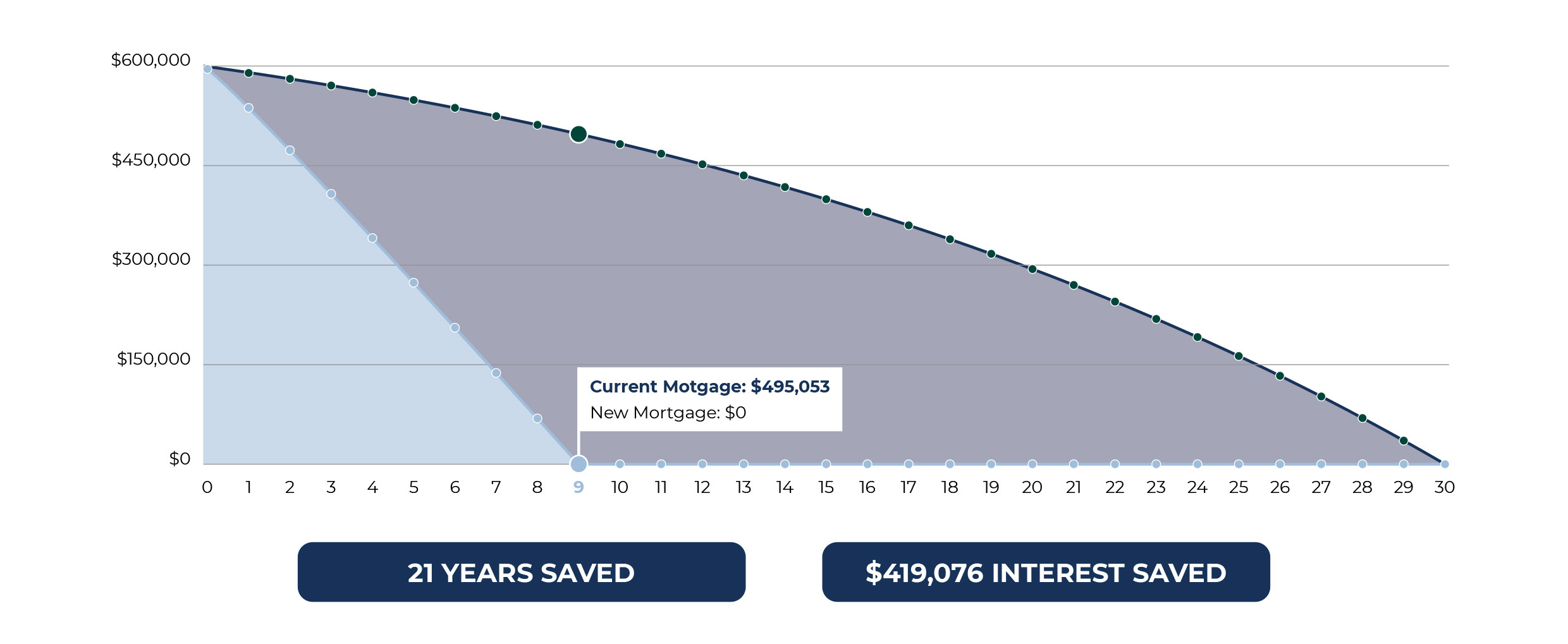

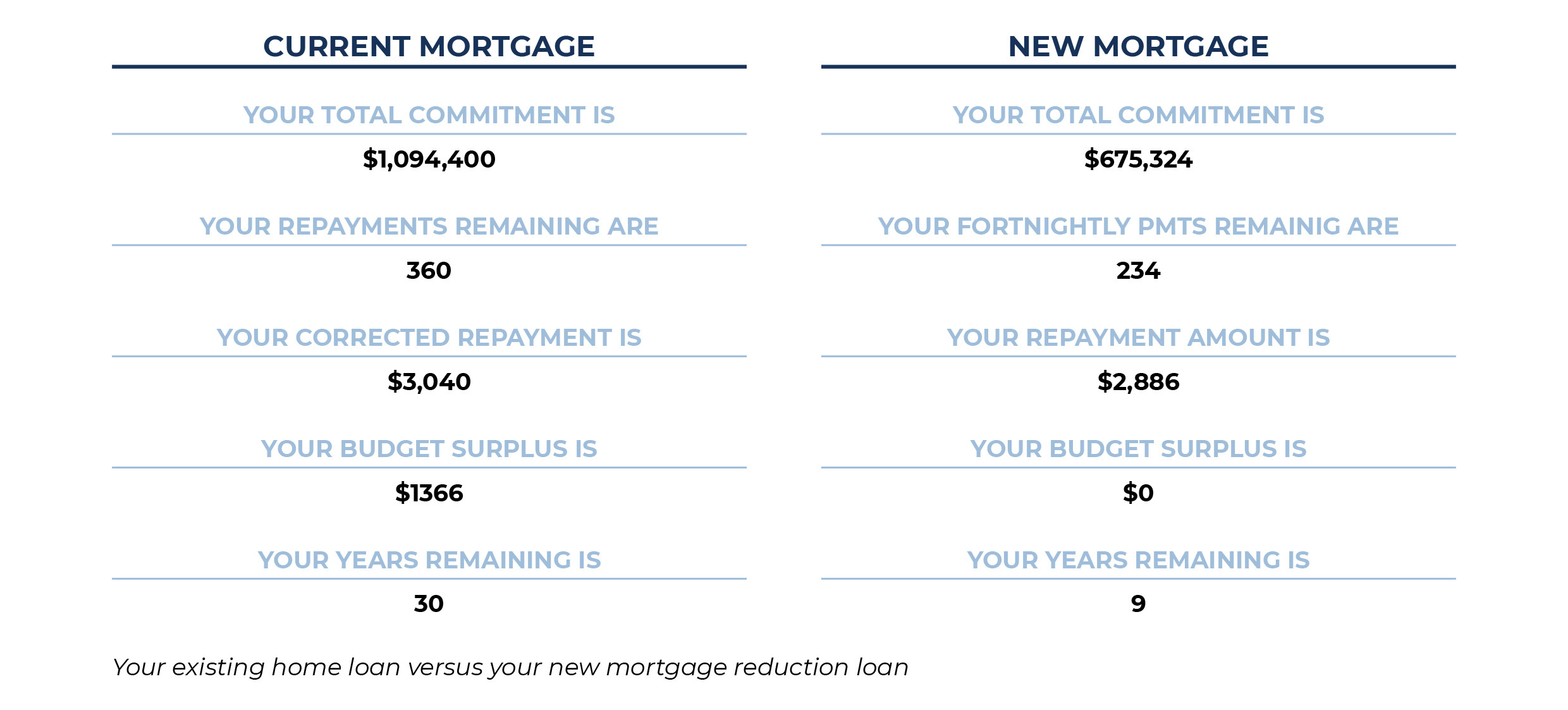

The chart below shows a traditional loan of $600,000 that will be paid over 30 years on fixed payments—as well as how much interest you will incur. With an interest rate of 2.3%, the total interest you will pay adds up to $174,324, not including your monthly fees to the bank.

HOW DOES A MORTGAGE REDUCTION PROGRAM HELP YOU?

A mortgage reduction program can reduce your interest without increasing repayments. It does this by operating on a daily instead of monthly basis, as well as minimizing your balance whenever possible. In this setup, your interest needs to be calculated daily.

To do this, you will need to restructure your daily expenses and organize your cash flow so you can accommodate the changes without issue. In this setup, you will no longer have conventional savings and loans accounts. Instead, your wages will be directly paid to the finance facility that handles your money.

For your daily expenses, you can draw directly from your credit card, cheque book, phone banking, or EFTPOS whenever necessary.

ASSUMPTIONS

In the case study above, we made a few assumptions to ensure accurate and reasonable results. We assumed that combined household income is $133,000 and living expenses will not exceed the usual bank allowance for a family of three — married couple with one child.

These strategies are successful because we personalize them based on our client’s financial situation. Consult with experienced professionals at Wealth Hub Australia now to learn how you can reduce your loan repayments by years!

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*