WEALTH HUB JOURNAL

Perth Property Investment — Why the Western Australia Capital Is the Best Option in 2023

Web Hub Australia

March 22, 2023After the nationwide peak in property prices in spring of last year, interest rates recovering from pandemic-era lows drove a correction in the market. This caused property prices to fall and sparked countless grim headlines about an impending crash.

However, experts don’t believe the Australian housing market is crashing. And of all the capital cities, Perth has risen to the top as the best market for property investment in 2023. In fact, surveys show many Perth suburbs like Armadale, Canning, Gosnells, Kwinana, Rockingham, Swan, and Wanneroo have rising sales activity.

Let’s take a look at what experts say is happening in property markets across Australia and why Perth is so attractive for homebuyers.

How much are property prices really falling?

Studies don’t agree. And many doomsayers don’t seem to be taking into account the meteoric heights property values reached before the downswing began.

According to one report, property prices in capital cities saw a 5% decrease from April highs by the end of 2022. Their figures indicate Sydney and Melbourne fell the most, at -10.9% and -5.9% respectively. Faring better were Canberra and Brisbane, at -6% and -1.1% respectively.

CoreLogic’s estimates were even more bleak, claiming a 6.5% drop in capital property prices last year.

The senior economist at BIS Oxford Economics, Maree Kilroy, expects prices to fall a total of 11.5% from the peak in April 2022 to when property prices nationwide begin to climb again. She projects this will happen in the second half of this year.

However, BIS figures are lower than projections from other organisations. Their uniquely grim expectations see Sydney with the steepest drop at approximately 18%. However, they expect Perth to be relatively unscathed with a drop of only 4%. This resilience is a big part of why Perth is such an attractive investment right now. We’ll look at that more closely later in this article.

To put the downswing into perspective, let’s look at how much property prices climbed during the pandemic. Eliza Owen places the upswing in combined capital cities at 25% between late 2020 and the first part of last year. She’s the head of research for Australia at CoreLogic. In regional Australia, property values increased even more, reaching approximately 40%.

So property values that were once skyrocketing due to the pandemic are now correcting as the world returns to normal. And exclamations about an 18% drop in Sydney should be taken in context — as even that extreme projection is following a healthy increase of 25% among capitals nationwide.

So is this a crash or not?

Commentators say no. Owen at CoreLogic defines a crash as a situation where property values have devalued enough that people can’t service their mortgages and when they try to sell, they can’t cover their loan. She says this isn’t something we’re seeing in this market.

Kilroy at BIX Oxford Economics agrees. While she sees a downturn in the property market in general, she doesn’t expect a crash. This is because rent is high and the return of overseas migration is bringing in more potential buyers.

She also credits continued low unemployment, as it’s putting a cap on the number of properties on the market.

Why Perth is the best market for property investment in 2023

While interest rates bouncing back from pandemic-era lows is causing downturns in some markets, surveys indicate most suburbs surrounding Perth are remaining consistent or even rising.

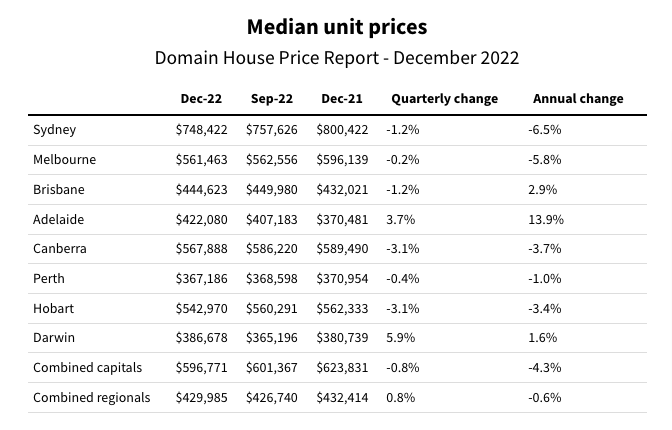

A December 2022 report shows how resilient residential property values in Perth have been over the past year. While the change in home values in capitals nationwide has been -4.3%, Perth has seen only -1% annual change.

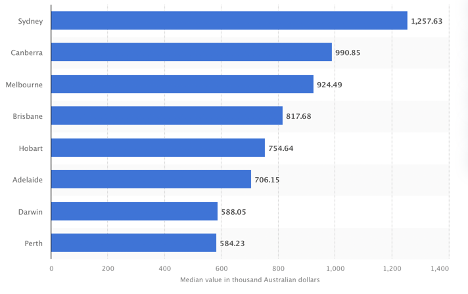

Moreover, Perth is the most affordable city for residential properties in Australia, with a median value of $584,230. For comparison, the median home value in Sydney is $1.26 million and $990,850 in Canberra.

Here’s a breakdown of median home values in state and territory capital cities based on the most recent data from October 2022:

As Perth shows growth potential in 2023 and beyond, it’s of course catching the attention of first-time buyers and property investors alike.

While market correction is causing home values to decrease nationally, the Western Australia capital is showing promising resilience. This makes Perth the best city for residential property investment today.

Perth area hotspots at a glance

Here’s an overview of some of the top cities in the Perth area with rising sales activity.

1. Armadale

- Suburb at the southeastern edge of the Perth metropolitan region, at the junction of South Western and Albany Highways

- Distance from Perth CBD: 28 km southeast

- Area: 559.5 km²

- Population: 94,184

- Attractions: Aboriginal Interpretation Centre, Araluen Botanic Park, Old Jarrah Tree (estimated to be 400-800 years old), three major water reservoirs, walk trails, and an area of regenerated bushland

- LGA: City of Armadale

2. Canning

- Local government area in the southeastern suburbs

- Distance from Perth CBD: 10 km southeast

- Area: 64.8 km²

- Population: 95,860

- Attractions: Woodloes Homestead local heritage museum, Cannington Leisureplex, Riverton Leisureplex, Whaleback Golf Course, parks and reserves

- LGA: City of Canning

3. Gosnells

- Suburb located within the City of Gosnells

- Distance from Perth CBD: 20 km southeast

- Area: 128 km²

- Population: 126,376

- Attractions: State forest, Central Maddington Shopping Centre

- LGA: City of Gosnells

4. Kwinana

- Suburb to the south on the Kwinana Freeway

- Distance from Perth CBD: 38 km south

- Area: 120 km²

- Population: 45,867

- Attractions: Kwinana Adventure Park, Kwinana Recquatic, Challengers Beach

- LGA: City of Kwinana

5. Rockingham

- Council and local government area comprising Perth’s south coastal suburbs

- Distance from Perth CBD: 43 km south

- Area: 257.5 km²

- Population: 135,678

- Attractions: Cape Peron, Perth Wildlife Encounters, parks and beaches

- LGA: City of Rockingham

6. Swan

- Eastern metropolitan region of Perth, includes Swan Valley and 42 suburbs

- Distance from Perth CBD: 20 km northeast

- Area: 1,042 km²

- Population: 155,653

- Attractions: Caversham Wildlife Park, Whiteman Park, Bells Rapids Park

- LGA: City of Swan

7. Wanneroo

- Local government area with city status, forms part of the northern boundary of the Perth metropolitan area

- Distance from Perth CBD: 25 km north

- Area: 685.8 km²

- Population: 209,111

- Attractions: Wanneroo Botanic Gardens, Wanneroo Regional Museum, Lake Joondalup, Yellagonga Regional Park, Quinns Rocks

- LGA: City of Wanneroo

Start your investment journey today

At Wealth Hub Australia, we help everyday Australians achieve financial independence, retire early, and build a legacy.

We will help you build cash flow and tax savings to reach your financial objectives sooner.

Our network of referral partners will be with you every step of your investment journey. Through our proven method, these industry experts will help you grow your investment portfolio, build wealth, and reach your goals.

Contact Wealth Hub Australia today to get started.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*