WEALTH HUB JOURNAL

Why Are There So Many Delays for Construction Materials?

Wealth Hub Australia

July 26, 2021New houses are springing up in record numbers across Australia, and construction material suppliers are rushing to meet the demand. However, strains on the global supply chain due to COVID-19 and worldwide shortages in timber and shipping containers—plus the loss of softwood plantations due to recent bushfires—have resulted in costly delays and higher prices for building materials.

Add to this the stimulus incentives for construction in numerous countries, including the HomeBuilder grant in Australia and a similar incentive/boom in America, and you have a perfect storm for a worldwide race for materials, particularly lumber from Asian mills. There may be great demand for new homes and renovations, but the supply of bricks, steel, windows, and, most of all, timber simply isn’t keeping up.

Why is timber so expensive?

With 130,000 new homes forecasted to be built in Australia this year, which is 10,000 more than the previous record set in 2017, delays and skyrocketing costs are partly due to logistics. Suppliers can’t predict when stock will arrive, so they can’t give builders estimated delivery times.

Raw timber produced locally has seen an increase of 20-25% in 2021, and that percentage likely isn’t done climbing. You can expect framing timber to increase approximately $5 per linear metre by year’s end—up from $3.75 at the beginning of this year. Additionally, the cost of imported timber, which makes up 20% of Australia’s supply, will likely rise at least 90%.

Additionally, wait time for laminated veneer lumber is 16 weeks as of June 2021. Before the pandemic, this high-strength wood product would typically be delivered within one to two weeks. However, the timber supply is expected to balance out by the end of the year.

The housing boom and how it affects you

According to a report by the Housing Industry Association (HIA), the number of new homes started in Victoria has surpassed 40,000 in one year for the first time in history. Tim Reardon, HIA chief economist, added that the number of new houses that began construction in the past 12 months is 20% higher than the previous record.

While the timber shortage is expected to level out in the next few months, the housing boom shows no signs of slowing down—and building costs are continuing to rise.

“Delivery times of four to 12 weeks are now fairly common. Builders need to manage that scheduling better than they have in the past because of the constraints on materials,” Reardon said.

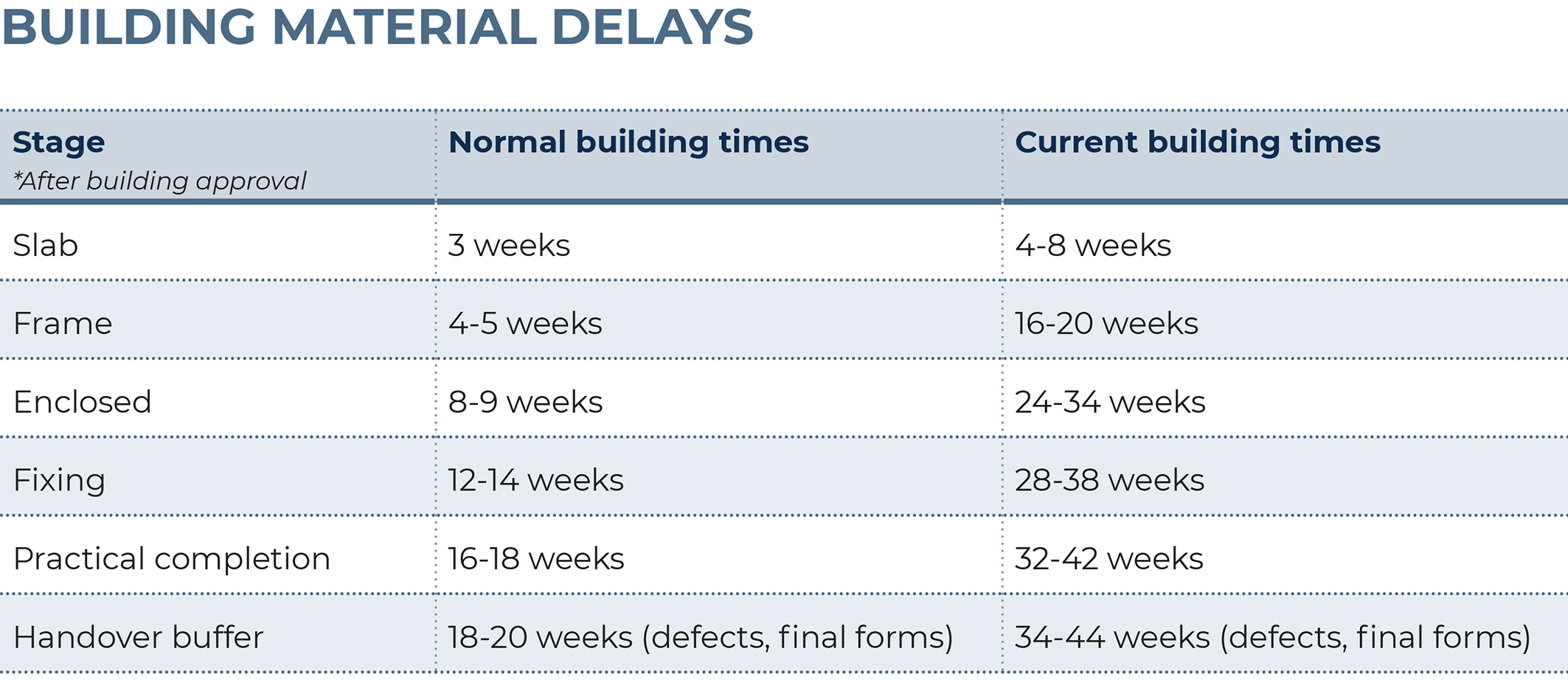

Allegra Homes, one of the builders we work with, has announced they are seeing delays from their suppliers and trades, and they estimate the following delays after building approval.

If you plan to commence construction on a new home in the foreseeable future, your costs may increase dramatically, and you will likely need to adjust any timeline expectations. Wait times for building permits have significantly increased compared to before the pandemic. In addition, you can expect a delay of a few weeks for builders to reach your site.

At Wealth Hub Australia, our team of finance professionals will walk you through the often-complicated steps of building your home. The market is ever-changing, and the global supply chain and access to building materials are especially unpredictable right now, but we are committed to staying on top of the latest developments so we can help you build your home, start creating wealth, and plan for the retirement you deserve.

We are here to answer your questions and guide you through the homebuilding process so you can be confident in building your future.

*Our officers, employees, agents, and associates believe that the information and material contained in this handbook is correct at the time of printing but do not guarantee or warrant the accuracy or currency of that information and material. To the maximum extent permitted by law, our officers, employees, agents, and associates disclaim all responsibility for any loss or damage which any person may suffer from reliance on the information and material contained in this handbook, or any opinion, conclusion, or recommendation in the information and material, whether the loss or damage is caused by any fault or negligence on the part of our officers, employees, agents, and associates or otherwise. The information relating to the law in this handbook is intended only as a summary and general overview on matters of interest. It is not intended to be comprehensive, nor does it constitute legal, financial, or taxation advice. Whilst our officers, employees, agents, and associates believe that such information is correct and current at the time of printing, we do not guarantee its accuracy or currency. Many factors unknown to us may affect the applicability of any statement or comment that we make to your particular circumstances, and consequently you should seek appropriate legal advice from a qualified legal practitioner before acting or relying on any of the information contained in this handbook. The information contained in the handbook is of a general nature and does not take into account your objectives, financial situation, or needs. Before acting on any of the information, you should consider its appropriateness, having regard to your own objectives, financial situation, and needs.*